When joining a conversation about open innovation we tend to hear buzzwords like “disruptive” or “cutting-edge” being thrown around. Can conversation around innovation practices be shifted away from trendy tropes and towards fact-based methods and measurable criteria? We believe it can. In the following article, you will be introduced to a few methods of formalising your business concepts for your innovation projects.

If you’re immediately filled with dread at the prospect of being shown that the answer to formalising concepts being found in heavy spreadsheets with a million entries and complex market analysis breakdowns — relax, this is not that kind of an article. Yet. Eventually, we will look into market analysis and business case planning.

But for now, we will examine a scenario where you are starting out with a bright idea for an innovation and you want something more concrete to back up your optimism and passion. To start, let’s set our aim at building a framed body of an augmented business concept. And let’s agree, that we’ll be able to call your idea a concept when you are able to answer and pitch the following:

- How does your product or service address the needs of the customers and users?

- What is unique about the way your idea will work? What will give it a competitive advantage?

- How will it be positioned on the market?

What’s new?

A great place to start answering these questions is a simple classification. Does your business idea innovate on the product or service itself, or do you suggest an alternative way of delivering already existing products to the target audience?

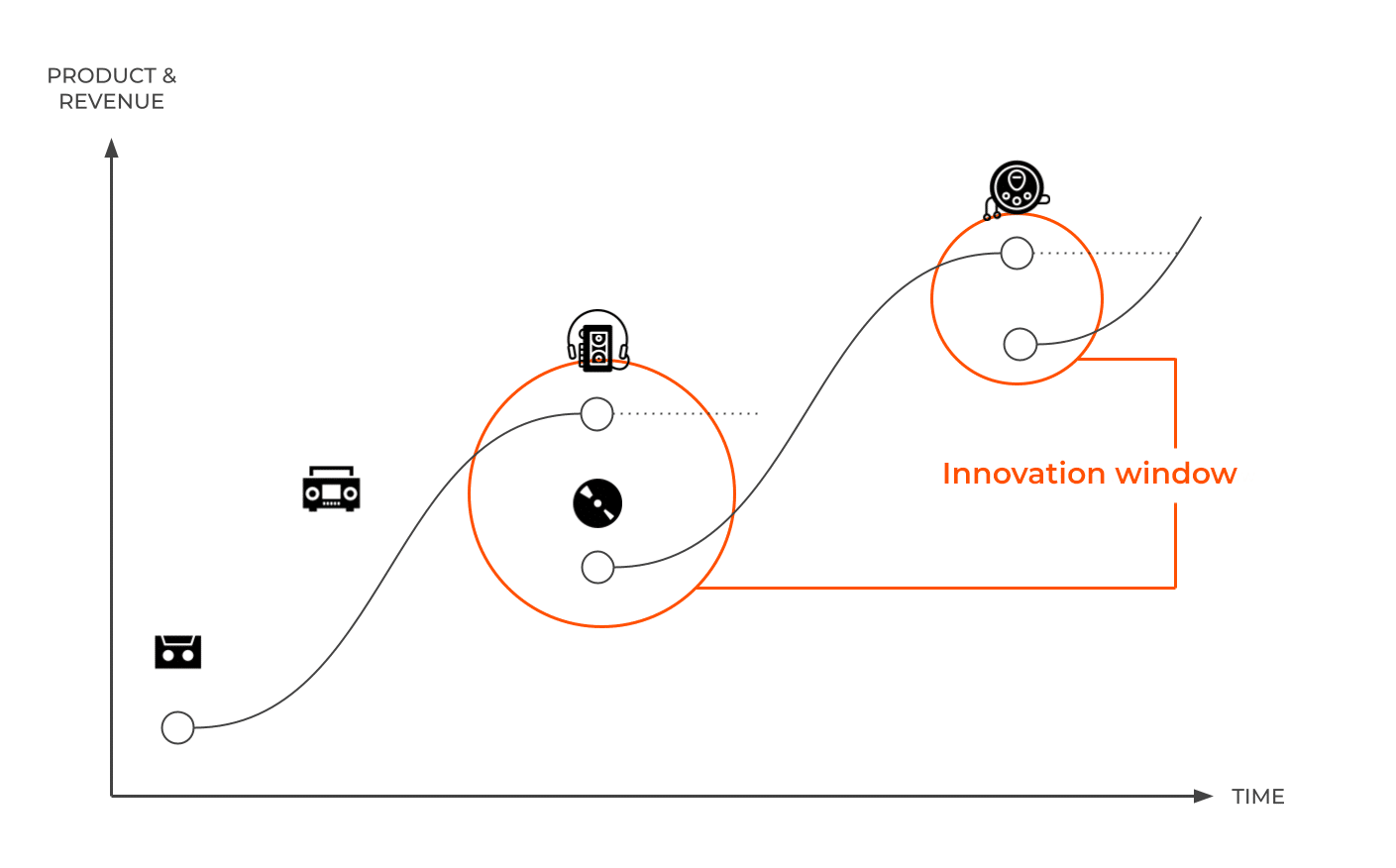

Take a closer look at the graph above. It is one of the classical examples of market change that is still familiar to most of us. The magnetic cassette tape made it possible to produce various kinds of portable music players. The market evolved to the state, where walkman cassette players became a common consumer good. Later, the wide adoption of CD as a format started a new line of products. CDs, in turn, were replaced by the fully digital mp3, and now we are living through the wide adoption of streaming platforms, which is forcing mp3-player producers out of business.

There are many ways of looking at this paradox, but one of the most visually clear is the S-curves of Innovation. It is a simplified view of change on the market that allows you to discuss your product positioning in the context of its actual relevance to the market.

Going back to the graph above, the vertical axis shows the performance of the product on the market. The horizontal axis shows effort, in our case reflected by time (in your graph it can be another measure, e.g. invested resources). If we were to adjust the timeline to reality and all numerical values of time passing onto the graph, we would see that some curves would become steeper.

To better understand the business concept quality, we can switch hats for a moment. We will teleport in time to 1982 and will be the judges of 3 innovation ideas that are cooking up in our consumer electronics company.

In 1982, both Sony and Phillips have co-developed and released compact disc products. They are fragile and it still costs a fortune to manufacture both the players themselves and the discs to play music. Cassette tape walkmans are still dominating the consumer market. All the ‘hip’ people have one, and your company has made 70% of its revenue on products related to cassette players. Your company did well last year and you have been allocated a healthy budget to introduce innovation processes and products.

Your colleague John is pitching a new cassette player. John is a bit of a skeptic when it comes to introducing new formats to the market. He suggests a sleeker, slimmer version of a cassette player that could be more attractive to particular audiences (such as joggers, fashion-fanatics, and travelers). Development of the new mechanics and establishment of the manufacturing line will take the full capacity of your tech team for the next year. It will cost quite a bit, but the market looks stable and you are almost guaranteed to make a profit on this new model for a year or two after a release.

Another member of your team, Kiara, comes prepared with a pitch with a different, more conservative, approach. In her opinion, the cassette players market is already threatened by the offering that CDs and CD players bring into the game. Kiara suggests halting the expansion of the portfolio and focusing efforts instead on improving current internal production processes, and simultaneously preparing to produce new types of players in a year’s time.

She suggests starting to experimenting with vendors of superior components that will work for both CD and tape players, and thus will allow a smoother transition into the new era.

This proposal yields significantly less in profit, but will allow your company to train the tech team and keep it intact during the transition from one format to the next. Remember, that it’s 1982, you are not yet sure the transition from cassette to CD will happen, or when.

There is not nearly enough data available about the difference in quality the CD supposedly boasts nor is their confirmation about positive public reception of the format. But, should this transition happen, Kiara’s suggestion makes sense.

Finally, a third member of your team, Alina presents a pitch that makes many people excited and equally as many rather angry. She has contacted a few factories in China and they are ready to do a test batch of CD-player components for you. Alina did some calculations and checks, and she is confident in your company’s ability to jump into the CD Player market with the production of new types of products within a few years. Her projections look very good but are found on the still unclear realisation of the cassette to CD transition. If the transition doesn’t happen, the investment would be for naught.

Which one of these pitches would you back? What fact-checks would you ask your colleagues to prepare for the next pitch? Meditate on it for a while. As a guest from the future you know that each of these ideas could have been good for the company. But the investment and projects would have had to be framed the right way. Once you have made your choice and compiled arguments for it, read through the cases below

“Conservative” innovation or innovating within the product line?

Let’s say you’ve sided with John and decided to strengthen your company’s existing standing within the cassette player product offering segment. How do you pitch the three aspects highlighted at the start of this article; value for the end-user, competitive advantage, and positioning?

Your company has been selling cassette players for years and you know your audience. You pulled up the focus group reviews of your latest product and conclude that there is plenty of evidence to the fact that buyers are calling for slimmer portable players and better performance under more stressful conditions. You quickly consulted with your product design team and they showed confidence that they can optimize existing product designs utilising new components widely available on the market. Technically, the case looks like a winner.

When it comes to potential competition, the challenge seems a lot harder. Recently, there have been plenty of Chinese alternatives to your product that have been taking over the lowest brackets of your target market. You will have to invest quite heavily into marketing, and you will need to push your development team to be ready to release fast. In addition to the existing competition, your main competitors are almost certainly going to release similar products too.

The new components you plan on using are not exclusive, your competitors are free to use them as well. Objectively, there is very little that your company can offer, that is not already on the cassette market.

John tells you that he has already been speaking to the marketing department — your last luxury product line has been selling well and has further solidified your brand’s name in the high-tier league. Hence, what you can’t win with a competitive advantage, you can make up for with the right positioning. You and John pitch an idea for a high-performance tape player with a luxury design that will be sold at the upper range of the mid-tier prices. You will project a bit of quality awe around the item. While your product won’t wildly differ from the rest of the mid-tier pack, your brand credibility will make you stand out in the eyes of your customers. The company should have a good margin on this product since most of the components and production value-chains are already well familiar to your team.

Even very conservative projections for such a project show guaranteed profit within a year. The project will pay for itself and you and John will get a nice bonus, when the sales cross into the profitable space. However, this project has a significant risk. You already know, that your biggest competitor has head-hunted an academic, who has been developing early CD tech. You know that they are expanding their brand presence into this new space. Should this tech have a good takeoff – your development team will need another year or two to catch up. Will you ever be able to recover? Will you have enough cash on the company account next year to pull off another innovation project?

One of the most common examples of companies taking such a risk lightly was the case of Nokia postponing the release of a touch-screen smartphone for many years. In Nokia, they’ve even had all the elements ready to develop push such a product to the market, but they have chosen to remain within the safe and established feature phone category and rapidly lost the phone market leadership.

“Strategic” innovation or innovating your company via upskilling?

What if you would had gone with Kiara’s suggestion of improving existing internal production processes while also preparing for the future? Can slow increase of competence in innovative components guarantee you long-term stability? Let’s review the same basic components of the pitch.

Introducing new components to existing products may not be immediately attractive for the mass audience. But then, as we already have examined — the lower margins of your offering have already been compromised by the cheaper Chinese alternatives. At the same time, the high-tier buyers, who really care about the specs of your products will be happy to find extended audio range and an improved stabiliser. Both will be critical should the CD format transition realise. Kiara has spoken to the product development team and they know what should be tested in order to pick the component vendors. The lead developers are extremely happy to support this project — for them it is professionally vital to stay on top of the market practices. They are being actively scouted by your competition, and having them interested in the project is a win in itself.

Competitive advantage in this case is nearly as weak, if not weaker, than it is in John’s proposal. However, having improved specs for your products will almost certainly cement your brand in the professional-standard category. It is quite a natural move for your company, but it will require a heavy investment into specialised marketing targeted at sound professionals. There is a need for an additional study on market saturation and market demand for a new product like the one you can offer.

Positioning for this new product is fairly clear; you will be selling to professional musicians and sound engineers. Which is just a different way of saying that you will be selling significantly fewer items at a much higher price point. The timing for this is good. Cassette technology has been around for a while. There are many factories that can produce your designs and component vendors that can provide you with high-quality, innovative hardware. The product design team will be thrilled to produce a state of art device, even if it is a fairly common-place art today.

Strategically, taking this route is allowing you to get a foot in the door of the new era. Well, perhaps not a whole foot, but, a tippy-toe. And your team will be ready to work with the high-fidelity sound components that CD format calls for.

Where things can go wrong is in sales. The unfortunate reality is that it’s a lot harder to predict sales in the professional segment. Market gets saturated very quickly, and your competitive advantage is not all that strong. You should conduct a very accurate market study before you place your bet on this option. If you can guarantee the positive financial outcome with a higher level of certainty, your bonus this year could be smaller, but you can be sure that you and your colleagues will have a place to work at in the next 5 years, even if the CD becomes the primary music format.

Nowadays, the general trend is leaning towards the targeted product marketing. Targeted products don’t have to be only for professional or exclusive markets, but specialisation is quite often a preferred strategy for the companies that operate within developed economies.

“Disruptive” innovation or innovating on the product category?

Let’s say you are sharing Alina’s enthusiasm about the adoption of the new emerging format of CDs. Maybe you’ve have visited an industry exhibit booth this year and heard the crisp clear CD demo, which caused you a week nights spent excited and sleepless, consumed by thoughts of potential profits and innovation. You still need to get yourself together, and compile this pitch, capitan!

After a few nights of frantically looking through the tech documentation you come to product design team with a draft of a brand new concept. It looks like it will take your team from 1.5 to 2.5 years to release this new concept player to the market. Your team is on the edge. There are many engineers, who seem lost and bombard you with the questions beyond your comprehension. It seems like you will need to hire one or two engineers with prior experience that will be responsible for the high-fidelity sounds and the CD format adoption.

Should you start development this quarter — you would have a definite time advantage over your competitors. It will be a long time before the mass market is flooded with accessible CD-players. Even if there a few more players in the same field, the level of the market saturation remain low for the next 5 years. You should be able to cover the costs of development investment with a rather high level of certainty.

When it comes to positioning, you do not need to innovate too much. The walkmen market has its buyers and is only growing by the year. You know that for the next year there is no need to worry about it, since the major recording labels are still only entertaining the idea of the CD releases. You can release your first product at the top of the mid-range prices. Early adopters will buy it just because it is new, without much additional marketing on your side. The hype around this new tech is selling the products. And a year later, when your value chain is stable, you can be one of the first companies offering affordable models of the CD-players.

We see such products all the time, with some of them making quite a big splash. If we think about modern examples, Netflix has gone from revolutionising the movie rental industry via sending rented DVDs through the mail to a streaming giant with its own production studios and an impressive collection of award-winning original series. They have utilised the existing rental subscription model and the core base of users, but completely swapped the medium, when it was clear that the physical disc era was over.

Outside the ICT sector, such dramatic pivots are associated with significant challenge of updating hardware fleets. In 2020, enthusiasts like your colleague Alina are recommending energy companies such as Chevron Corporation to significantly invest into algae-based fuels instead of expanding their profitable, but doomed, fracking effort. But while biotechnology is opening fantastic new opportunities, the traditional energy industry will take at least a decade to integrate these new practices. Due to the reality that a single factory pilot can be priced upwards of 7 or 8 figure numbers, you will face resistance when you suggest swapping key reagents or replacing the entire conveyer belt with drones and robots.

Conclusion

Your project will exist somewhere on the spectrum of innovation: from the safest tweaks to existing products to a completely wild endeavours into the unknown that revolutionise industries. What remains permanent is the need to identify your end-user, your standing amid the competitors, and your product’s place on the market. Also understanding where your concept exists on the curve of the technology lifetime will go a long way in conducting regular reality checks. There are no “wrong concepts”, yet there are concepts that include more strategic risk for a company. A great innovation concept combines a vital business idea with an injection of needs at the core of your industry’s context.

- Long story short, when framing a business concept for an open innovation project, assess:

- How does your product or service address the needs of the customers and users?

- What is unique about the way your idea will work? What will give it a competitive advantage?

- How will it be positioned on the market?